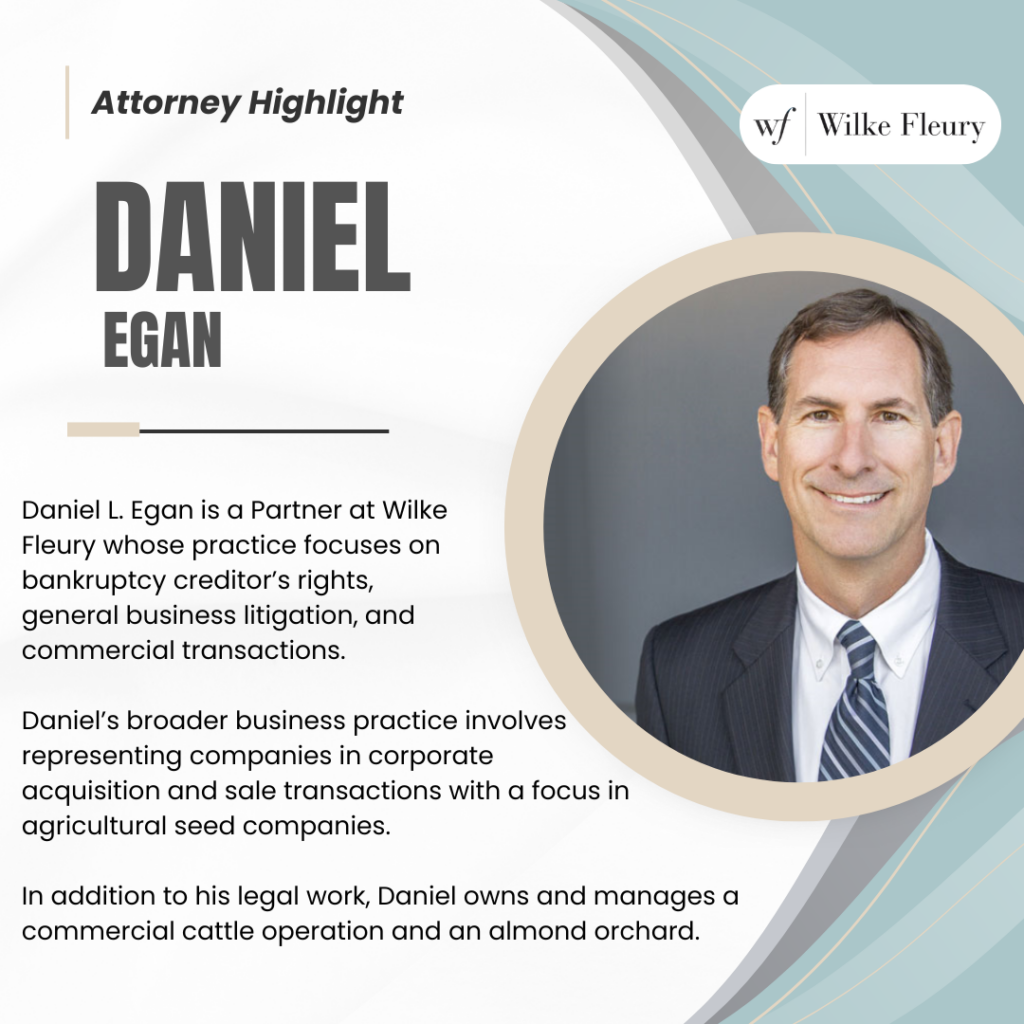

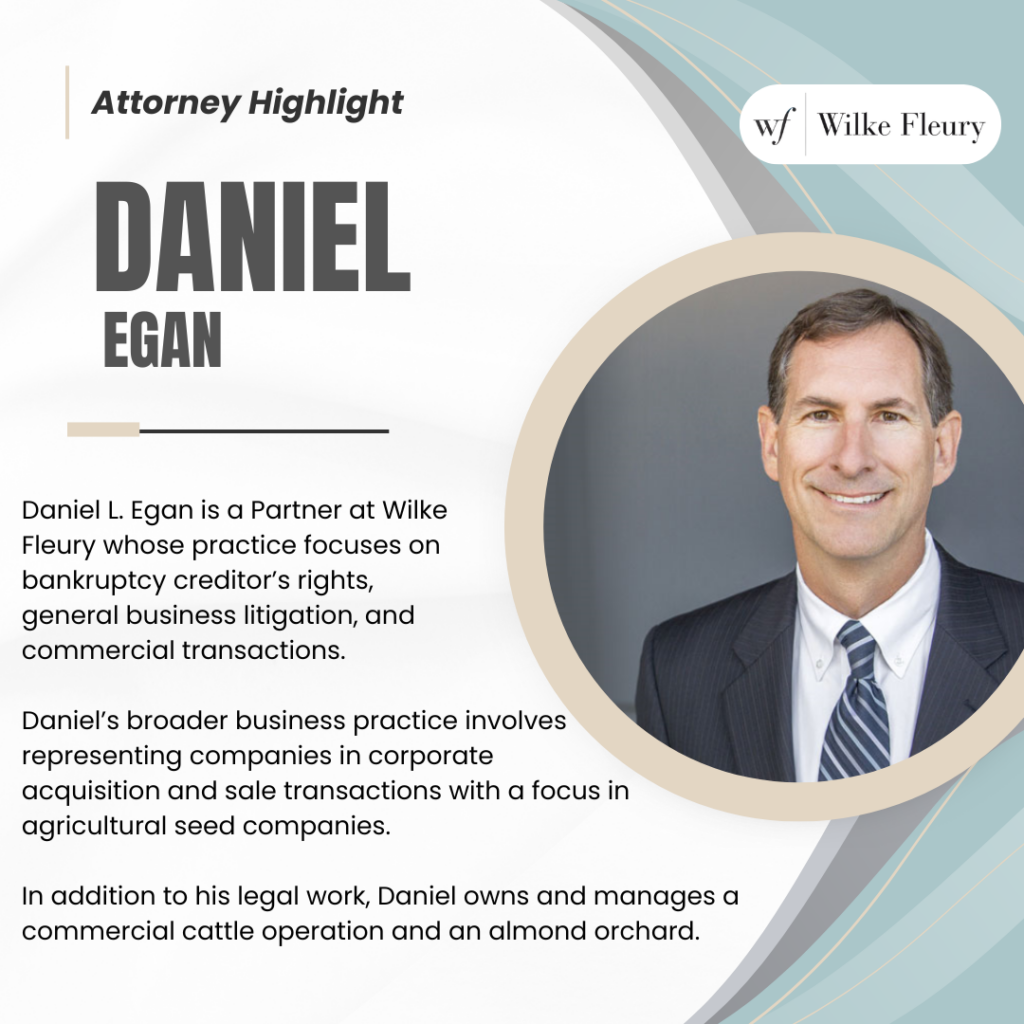

Read more about: Daniel L. Egan

Read more about: Daniel L. Egan

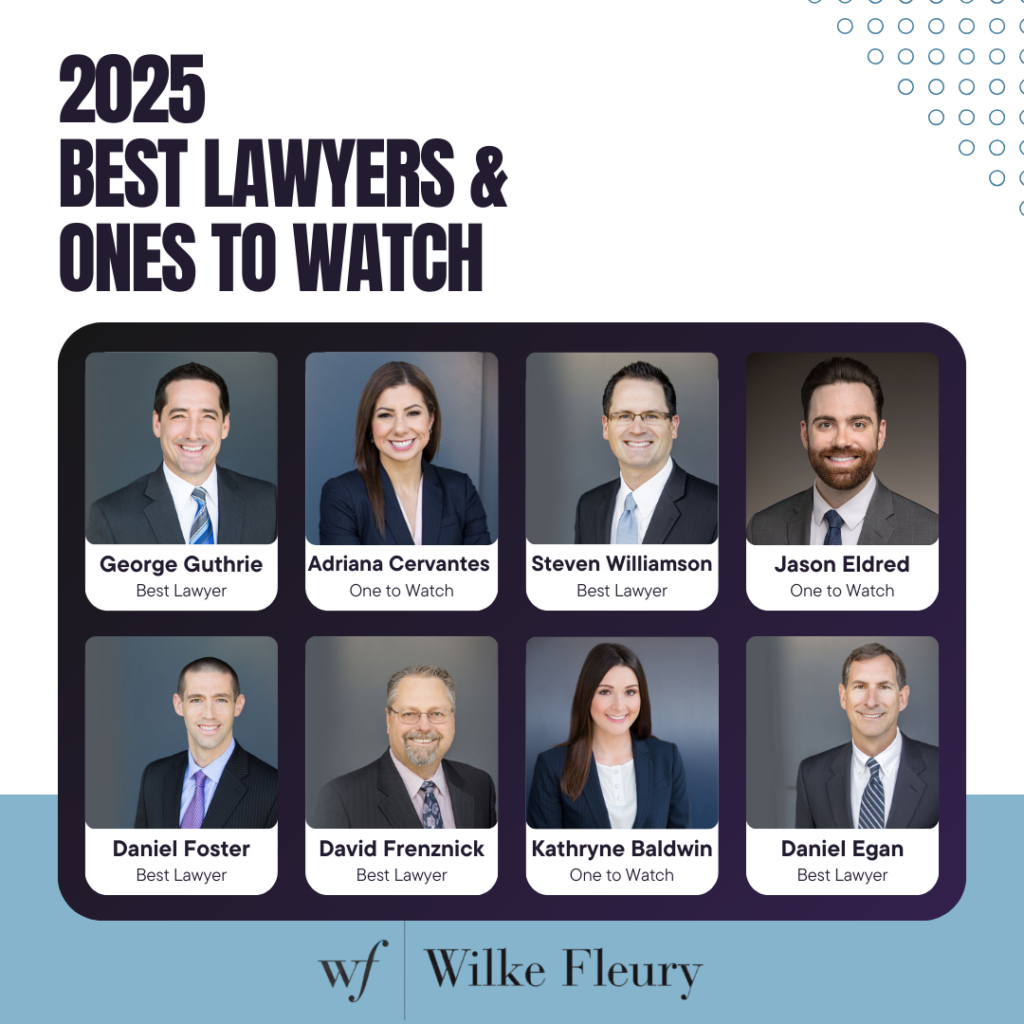

Wilke Fleury is extremely proud to have five attorneys recognized in The Best Lawyers in America and three attorneys recognized in the Best Lawyers: Ones to Watch in America! Best Lawyers has been regarded by lawyers and the public for more than 40 years as the most credible measure of legal integrity and distinction in the United States. Congratulations to this talented group!

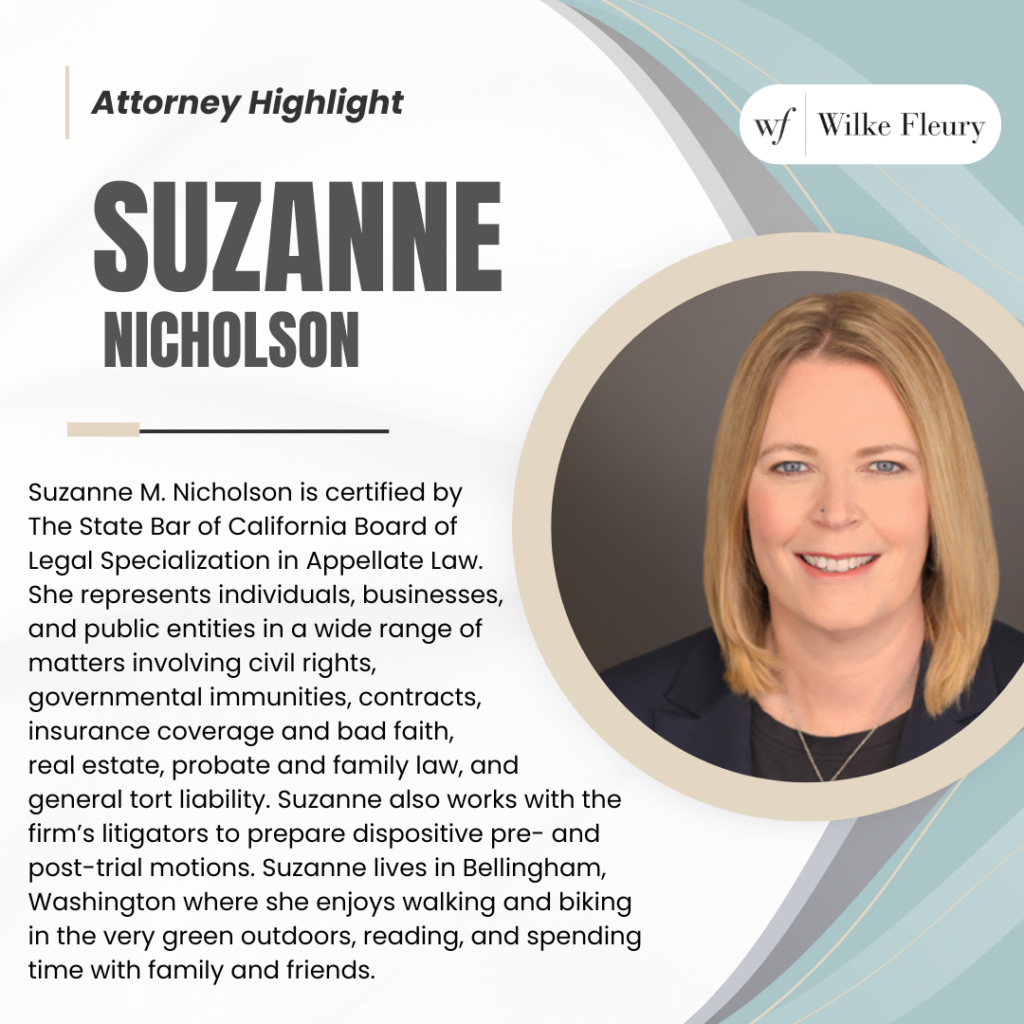

Read more about: Suzanne M. Nicholson

By: Mena M. Arsalai, Kimberly V. Martinez, and Alexandra J. Porter

In a significant development marking a pivotal moment in California’s healthcare landscape, the Office of Health Care Affordability (“OHCA”) has broadened its regulatory oversight of healthcare transactions. The California Office of Administrative Law recently approved OHCA’s regulations under which “health care entities” are required to notify OHCA of “material change transactions” at least 90 days before closing for transactions finalized on or after April 1, 2024 (the “CMIR Regulations”).

Once a material change notice (“MCN”) is filed, OHCA has 60 days to decide whether to (i) conduct a cost and market impact review (“CMIR”) of the proposed transaction or (ii) waive such review. OHCA is required to conduct a CMIR if the proposed transaction poses a risk of significant impact on market competition, the state’s ability to meet cost targets, or costs for purchasers and consumers.

The first MCN filing was deemed completed on April 12, 2024. While this filing offered a first look at how OHCA will manage its CMIR process, the contemplated transaction in the filing did not relate to the sale of a business. Rather, as described in the notice, the submitter entered into the transaction solely as an accommodation to the landlord and its new operator/tenant. “Submitter is not ‘selling’ its business, but is agreeing to transfer the business operations to the new operation when the new operator obtains its license to operate the Facility.” Based on the facts of this notice, OHCA ultimately decided to waive the CMIR.

OHCA recently entertained its second MCN filing[1]. Unlike the first filing, this transaction contemplated the sale of a business, Invitae Corporation, a biotechnology company that provides genetic testing services. Invitae Corporation filed for Chapter 11 bankruptcy, and the bankruptcy court approved the sale of Invitae Corporation’s assets to Laboratory Corporation of America Holdings, a national provider of clinical laboratory services. The second MCN filing was deemed completed on June 5, 2024.

This latest MCN filing described the transaction as “an asset sale, through which LabCorp Genetics, Inc., a newly formed entity, will acquire certain assets of Invitae Corporation in accordance with the negotiated Asset Purchase Agreement and certain requirements under the bankruptcy code.” The goal of the transaction was described as “for Invitae to sell its assets to pay its creditors and settle its executory debts, while maintaining patient access to Invitae’s services.”

OHCA concluded its review by waiving the CMIR. A few of the details in this notice that may have helped OHCA reach this conclusion include the following:

Each MCN filing is significant because it provides guidance on how OHCA will interpret and enforce the relatively new CMIR Regulations. California healthcare entities will benefit from closely reviewing each MCN filing and as more filings are made, we will gain a better understanding of the process.

Wilke Fleury is extremely proud that several of its incredible attorneys have been selected as 2024 Northern California Super Lawyers or Rising Stars! Super Lawyers rates attorneys in each state using a patented selection process and publishes a yearly magazine issue that produces award-winning features on selected attorneys. Congratulations to this talented group:

2024 Super Lawyers:

2024 Rising Stars:

Check out the full profile on Trevor by following this link: https://online.fliphtml5.com/yzguw/lraj/#p=10

By: Jizell K. Lopez

On September 30, 2023, Governor Gavin Newsom signed California Senate Bill 553 (“SB 553”) into law. Among other things, SB 553 added section 6401.9 to the California Labor Code, which requires that virtually all employers, implement a workplace violence prevention plan by no later than July 1, 2024.

The California Occupational Safety and Health Act of 1973 (“Cal-OSHA”) already imposes many safety-related obligations on employers, including the requirement that they establish, implement, and maintain an effective injury and illness prevention program (“IIPP”). SB 553, which is the first law of its kind in the nation, now requires that employers in non-healthcare settings take additional steps to address the specific threat of workplace violence. As mentioned above, this new law covers virtually all employers. However there are some exceptions, including: places of employments with fewer than 10 employees—these locations must not be accessible to the public; teleworking employees; healthcare facilities already covered by Cal/OSHA’s Workplace Violence in Healthcare Standards; law enforcement agencies; and certain public entity employers.

Starting July 1, 2024, covered employers must establish, implement, and maintain a Workplace Violence Prevention Plan and must meet four broad categories of obligations: (1) the creation of a workplace violence prevention plan; (2) the creation of a workplace violence incident log; (3) employee training requirements; and (4) recordkeeping requirements.

Creating a Workplace Violence Prevention Plan

The intention of this violence prevention program is to provide a roadmap to both employees and employers to address actual and potential incidents of workplace violence. By July 1st, employees and employers should be able to identify and mitigate against workplace violence incidents or threats. Labor Code section 6401.9 defines “workplace violence” as any action of violence or threat (excluding lawful acts of self-defense and defense of others) that occurs at a worksite. The Labor Code further provides definitions for four types of “workplace violence” that employers must be able to recognize and identify in its incident log and train employees to recognize these specific types of workplace violence:

For convenience, Cal-OSHA has released a model Workplace Violence Prevention Program for employers to use. This can be found directly on Cal-OSHA’s website.

Violent Incident Log Requirements

Employers must document and maintain a log of all incidents of workplace violence, even if the incident did not result in an injury. The log record must be based on information solicited from the employees who experienced the workplace violence, witness statements, and investigation findings. Further, the log must be anonymous and must be periodically reviewed.

The log must include the following information:

Employee Training

Employers must also provide employee training regarding the hazards specific to that employer’s workplace by July 1, 2024 and annually thereafter. The training must address all of the following:

Recordkeeping Requirements

Finally, employers must also comply with certain recordkeeping obligations and retention periods as follows:

Conclusion

California’s new Workplace Violence Prevention Program is a landmark initiative aimed at enhancing worker safety and reducing the risk of violence in the workplace. As the July 1, 2024, implementation date approaches, employers must prepare to comply with the new regulations by developing comprehensive and effective Workplace Prevention Plans. This proactive approach not only protects employees but also fosters a culture of safety and respect in California’s workplaces, setting a precedent for other states to follow.

On January 1, 2024, the federally enacted Corporate Transparency Act (“CTA”) came into effect. The CTA requires certain entities to disclose information regarding their beneficial owners to the Financial Crimes Enforcement Network by the end of the year. These reporting requirements seek to prevent private use of shell entities as a tool to facilitate money laundering and other financial crimes.

As the deadline quickly approaches, closely held businesses should examine their reporting requirements.

Who is required to report?

Reporting companies are corporations, limited liability companies, limited liability partnerships, and other similar entities created by, or registered to do business under, “the filing of document with a secretary of state or similar office under the law of a State or Indian Tribe.”[1] This definition includes non-profit corporations and trusts that have secretary of state filings.

What companies qualify for exemption?

The CTA provides several exemptions which generally cover entities already subject to other federal reporting requirements.[2]

Wilke Fleury LLP is delighted to announce the addition of its newest partner – Islam M. Ahmad. Mr. Ahmad is a talented addition to the firm’s leadership. He brings with him a wealth of experience, and is a forward-thinking leader who will be invaluable to the firm’s leadership. His practice focuses on real estate and business law with a specific focus on litigation and insurance coverage matters.

“We are incredibly excited to welcome Islam to the partnership. He is tireless in pursuit of our clients’ goals, and in doing so employs both creative legal tactics and common sense. He is an asset to our firm and his admission to the partnership is well-deserved,” said Steve Williamson, Managing Partner.

Wilke Fleury LLP is a thriving mid‐sized general practice law firm located in California’s capitol. Our attorneys offer broad expertise, creativity, and strong ties to local businesses, families, and individuals, making Wilke Fleury LLP one of the region’s most respected and long‐standing law firms. Our support of local charitable organizations, universities, law schools, political interests and the community reveals the character of the firm and our sincere commitment to the Sacramento region.

Wilke Fleury is excited to announce that it has promoted two associates to the position of Senior Counsel — Mena Arsalai and Jizell Lopez. Mena and Jizell have demonstrated professional excellence and contribute greatly to the firm’s multi-generational leadership.

“Promoting Mena and Jizell to Senior Counsel is a reflection of the skill and dedication they bring to the practice of law, and an acknowledgement of their value to the firm. They understand our clients’ needs and work incredibly hard to achieve their goals. We are fortunate to have them on our team, and I congratulate them both!” – Steve Williamson, Managing Partner.

Senior Counsel at Wilke Fleury have at least six years of experience delivering high-quality legal services, collaborate with partners on the development and management of key practice areas, and actively mentor junior lawyers.

Mena Arsalai‘s practice focuses on supporting health care providers in regulatory and transactional matters. She has experience in drafting purchase agreements and ancillary transaction documents, healthcare facility licensing, healthcare acquisitions, physician contracting, and compliance. Prior to joining Wilke Fleury, Mena was an associate attorney at a Sacramento-based boutique law firm specializing in health law, mergers and acquisitions, and securities law.

Jizell Lopez is a civil litigation defense attorney who primarily represents employers in federal and state court litigation and before administrative agencies regarding all manner of employment claims, including single-plaintiff lawsuits, class action lawsuits, and wage and hour representative lawsuits. Jizell’s practice includes regularly defending employers against allegations of harassment, discrimination, wrongful termination, retaliation, wage and hour non-compliance, and more. In addition to her litigation experience, Jizell regularly counsels employers regarding the full range of California employment law compliance and litigation prevention. A large part of her practice also includes negotiating and drafting employment agreements, separation and severance agreements, and working closely with employers to develop effective personnel policies. Prior to joining Wilke Fleury, Jizell has represented both employers and employees. This has allowed her to utilize unique perspectives when counseling and defending employers, particularly with the ever-changing nuances of California employment law. Jizell chose to focus her practice on labor and employment defense because even when employers have the best intentions, there are far too many instances that result in costly and time-consuming litigation that could have been prevented or mitigated.

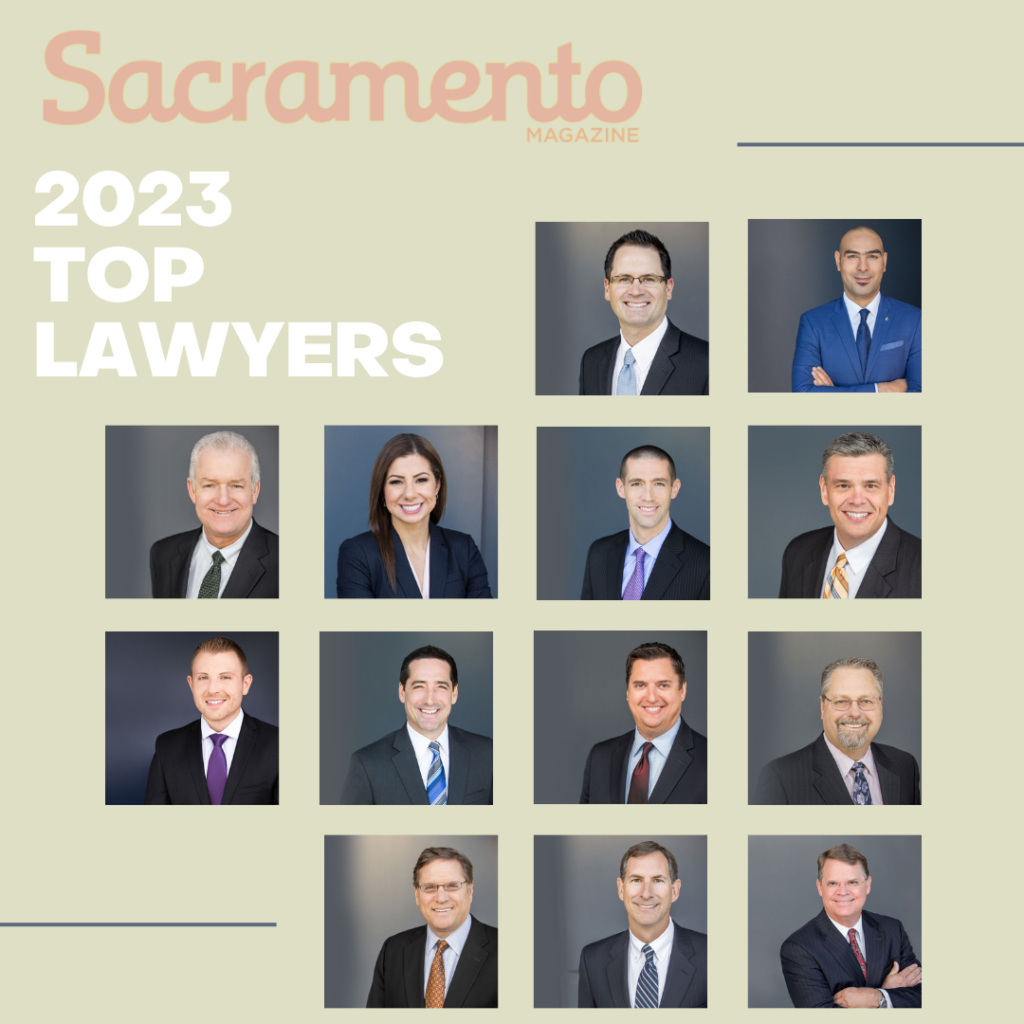

Wilke Fleury is extremely proud of its incredibly talented attorneys! Congratulations to Steven Williamson, Islam Ahmad, Matthew Powell, Adriana Cervantes, Daniel Foster, Neal Lutterman, Aaron Claxton, George Guthrie, Trevor Stapleton, David Frenznick, Michael Polis, Daniel Egan, and Stephen Marmaduke, who are all featured in Sacramento Magazine’s 2023 List of Top Lawyers!

By Jizell Lopez

The worker classification of relief veterinarians has been a hot button issue for many years. Traditionally, relief veterinarians and veterinary practices have preferred the classic independent contractor arrangement. However, given recent changes in worker classification laws and the legal risks associated with misclassification, it is a good time for both relief veterinarians and veterinary practices to revisit their independent contractor agreements to determine whether currently classified independent contractors are, in fact, properly classified.

As a brief background, on April 30, 2018, the California Supreme Court issued its opinion in Dynamex Operations West, Inc. v. Superior Court (“Dynamex”), adopting new standards for determining whether a California worker should be classified as an employee or an independent contractor for the purposes of wage orders adopted by California’s Industrial Welfare Commission. On January 1, 2020, California Governor Gavin Newsom signed AB 5, expanding the application of Dynamex and making it more difficult for California workers to qualify as independent contractors. While this new standard has upended many traditional independent contractor industries, the California legislature acknowledged that some industries should be exempt from the AB 5 standard and, instead, the traditional analytical standard (known as the “Borello” test) should apply. Thus, AB 5 may have codified the Dynamex ruling, but it also carved out several exceptions, including for veterinarians.

AB 5 requires the application of the “ABC Test” to determine if workers are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code, and the Industrial Welfare Commission’s wage orders. Under the ABC Test, a worker is considered an employee and not an independent contractor unless the hiring entity satisfies all three of the following conditions: (A) the worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact; (B) the worker performs work that is outside the usual course of the hiring entity’s business; and (C) the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

By contrast, the Borello test relies on multiple factors, including whether the potential employer has all necessary control over the manner and means of accomplishing the result desired (although such control need not be direct, actually exercised, or detailed). This factor must be considered along with other factors, including but not limited to: (1) whether the worker performing the services considers themselves as being engaged in an occupation or business distinct from that of the employer; (2) whether the work is a regular or integral part of the employer’s business; (3) whether the employer or the worker supplies the instrumentalities, tools, and the place for the worker doing the work; (4) whether the worker has invested in the business; (5) whether the worker hires their own employees; (6) whether the employer has a right to fire at-will; and (7) whether or not the worker and the potential employer believe they are creating an employer-employee relationship. Under Borello, no single factor controls the determination. Instead, the test relies on 13 different factors requiring consideration of the totality of circumstances attending the relationship. Accordingly, relief veterinarian classification can be complex, and subject to a case-by-case determination.

Both the Borello multifactor test and the ABC Test create a rebuttable presumption that the worker is an employee, and the hiring entity thus bears the burden of establishing that the worker is an independent contractor. The ABC Test is designed to be more predictable than the multifactor approach used under Borello. While AB 5 itself may not have changed the classification test applicable to veterinarians, the analytical landscape has shifted, and there are practical implications to understand for relief veterinarians.

You may ask, what is the big deal? Particularly if the worker wants to be classified as an independent contractor and the parties have agreed to this classification, and little to no risk flows to the worker. The party that bears the risk is the employer. In the event the worker is in fact misclassified, the employer could face significant liability—even if both the employer and employee both agree to the classification. Employees are entitled to certain rights that independent contractors do not typically enjoy, such as overtime, benefits, meal and rest breaks, and more. Furthermore, federal and state agencies may look back to determine if employers correctly withheld taxes, disability, and other payments, and paid for workers’ compensation benefits.

In the veterinary industry, many practices rely on relief veterinarians and the classification of these relief veterinarians as independent contractors. This article does not conclude that all relief veterinarians must be employees. Instead, it is a reminder to review any and all independent contractor agreements and their performance to determine whether these veterinarians may be classified as independent contractors. With recent legislation adversely impacting independent contractor designations in multiple industries, many current independent contractors have been given a moment to pause and ask whether they are in fact properly classified. Again, the penalties associated with misclassification can be high and can lead to significant employer liability.

The bottom line is that although AB 5 has been in effect for nearly three years, California veterinarians are still largely left guessing whether their classification is proper under the Borello standard. Given the trends discussed above, it will likely become increasingly difficult and risky to classify workers as independent contractors. Consequently, it is important for practitioners utilizing relief veterinarian assistance to revisit their relationships to determine whether an independent contractor classification is correct. In uncertain cases, consult qualified legal counsel!

By Kathryne E. Baldwin and José L. Parra

The nature of business is personal. Changes in personnel, project outlines, or business models cost businesses time and money to bring about, ward against, or stop. Any individual involved in business will likely have seen claims for interference with relationships, either prospective or contractual. But, what do those claims really mean and how viable are they in a capitalist society where free markets are held in such high esteem?

Defendants in lawsuits will typically see these claims pleaded as one of three major categories: intentional interference with prospective economic advantage, intentional interference with contractual relations or contract, or negligent interference with prospective economic advantage. As the name would suggest, the first two are more concrete and require a showing that the bad actor was aware of the existence of a contract or relationship and took affirmative steps to interfere with that relationship. The latter is more nebulous and looks at business relationships that were likely to occur and are based on a “should have known” standard.

The Framework

California Courts apply a careful analysis when considering each of the aforementioned claims. As set out in Jenni Rivera Enterprises, LLC v. Latin World Entertainment Holdings, Inc. (2019) 36 Cal. App. 5th 766, 782, the elements of a cause of action for intentional interference with contractual relations are “(1) the existence of a valid contract between the plaintiff and a third party; (2) the defendant’s knowledge of that contract; (3) the defendant’s intentional acts designed to induce a breach or disruption of the contractual relationship; (4) actual breach or disruption of the contractual relationship; and (5) resulting damage.”

The court in Rand Resources, LLC v. City of Carson (2019) 6 Cal. 5th 610, 628-629 discussed the similarities between intentional interference with contractual relationship and intentional interference with prospective economic advantage:

The two intentional interference claims share many elements—principally, an intentional act by defendant designed to disrupt the relationship between plaintiff and a third party. (Edwards v. Arthur Andersen LLP (2008) 44 Cal.4th 937, 944 [81 Cal. Rptr. 3d 282, 189 P.3d 285] [stating that an intentional interference with prospective economic advantage claim requires, among other…]things, “an intentional act by the defendant, designed to disrupt the relationship”]; Quelimane Co. v. Stewart Title Guaranty Co. (1998) 19 Cal.4th 26, 55 [77 Cal. Rptr. 2d 709, 960 P.2d 513] [laying out the elements of an intentional interference with contract claim, one of which is that the defendant undertook “‘intentional acts designed to induce a breach or disruption of the contractual relationship’”].)

One key distinction between claims for interference with contractual relations and prospective economic advantage is the requirement of an “independent wrongful act.” (Crown Imports, LLC v. Superior Court (2014) 223 Cal. App. 4th 1395, 1404, citing to Korea Supply Co. v. Lockheed Martin Corp. (2003) 29 Cal.4th 1134, 1158–1159 and Della Penna v. Toyota Motor Sales, U.S.A., Inc. (1995) 11 Cal.4th 376, 392–393.) An “independent wrongful act” requires a showing that “the alleged interference must have been wrongful by some measure beyond the fact of the interference itself.” (Ibid.) This means there must be some other wrong, separate and apart from the interference.

One court defined the distinction between intentional and negligent interference with prospective economic advantage as one that boils down to an evaluation of the defendant’s intent. (Crown Imports, LLC v. Superior Court, 223 Cal. App. 4th 1395, 1404, fn. 10.) In contrast, a claim for negligent interference with prospective economic advantage is established when a plaintiff demonstrates:

(1) an economic relationship existed between the plaintiff and a third party which contained a reasonably probable future economic benefit or advantage to plaintiff; (2) the defendant knew of the existence of the relationship and was aware or should have been aware that if it did not act with due care its actions would interfere with this relationship and cause plaintiff to lose in whole or in part the probable future economic benefit or advantage of the relationship; (3) the defendant was negligent; and (4) such negligence caused damage to plaintiff in that the relationship was actually interfered with or disrupted and plaintiff lost in whole or in part the economic benefits or advantage reasonably expected from the relationship.

(Venhaus v. Shultz, 155 Cal. App. 4th 1072, 1078.)

Competing Policy Considerations

When evaluating these claims, Courts weigh other policy considerations as well. When found in the context of an employment case, Courts give credence to the well-respected American value that employees are free to move between employers. (Redfearn v. Trader Joe’s Co. (2018) 20 Cal.App.5th 989 (overturned on other grounds in Ixchel Pharma, LLC v. Biogen, Inc. (2020) 9 Cal.5th 1130).) Stated another way, a former employee of a company has the right to engage in competitive business for themselves and enter into business in competition with the former employer, provided it is fairly and legally conducted. (Reeves v. Hanlon (2004) 33 Cal.4th 1140.) As a rule, Courts disprove of efforts by employers to squelch this freedom of movement.

For both negligent and intentional interference with contractual relationships, Courts are understandably protective of the rights of contracting parties. The right to contract freely is another right enjoyed by society and those without legitimate social or economic interests should not interfere in the expectations of contracting parties. (Applied Equipment Corp. v. Litton Saudi Arabia Ltd. (1994) 7 Cal.4th 503.)

These policy considerations comprise the basis for the defenses of these types of claims. While wrongful conduct that amounts to interference in contracts or business relationships can be inappropriate, these causes of action can prove to be amorphous because there are special considerations afforded to defendants, which are not considered in a stricter breach of contract or defamation-type claim.

Using the Framework

The causes of action are inextricably intertwined and, without counsel to assist in guiding a defense, these claims can often blend together. Small business owners looking for the first time at a lawsuit alleging these claims will undoubtedly see many of the elements amongst them on repeat and have questions. Looking at some recent examples of how courts are evaluating these cases can be helpful. In Richards v. Farmers Ins. Exch. (2023) 2023 Cal.Super. LEXIS 42051, a Court found a demurrer to claims for intentional interference with an economic relationship with a probable economic benefit was inappropriate. The Richards court found the Complaint adequately stated an intentional interference in a discrimination case that alleged supervisors at Farmers had taken the plaintiff’s clients from her and gave them to younger agents of a different race; in so ruling, the Richards court found a likely economic advantage because of the length of time the Plaintiff had them as clients. (Id. at *10.)

In Yang v. Paz Am 1300 (2023) 2023 Cal.Super. LEXIS 40196, a motion for summary judgment was granted when the Yang plaintiff could not demonstrate an independent wrong; even though the plaintiff argued the defendants had separately breached a fiduciary duty to a third party. (Id. at *14.)

Defenses

In crafting a defense to the family of interference claims, there are two common types: 1) the Anti-SLAPP Motion and 2) an argument no independently wrongful conduct took place. An Anti-SLAPP motion is used to attack meritless causes of action that are inappropriately based on acts of freedom of speech. (Baral v. Schnitt (2016) 1 Cal.5th 376.) As discussed above, there are competing interests when evaluating intentional or negligent interference claims. To the extent the alleged improper conduct arises from a protected freedom of speech act (e.g., advertising, working as an employee, or soliciting business), a business owner who finds themselves a defendant in cases with these claims should look first at whether an Anti-SLAPP Motion to strike that cause of action is appropriate.

In addition, a defendant in an interference with prospective economic advantage (either intentional or negligent) claim must have committed some independent tort, separate and apart from the interference. Oftentimes, plaintiffs make tenuous claims about the existence of the independent tort. If the conduct alleged is not sufficient as a matter of law, a well-timed demurrer early on can serve to narrow the issues and get rid of frivolous interference claims. Be sure to retain qualified counsel early on to have sufficient time to evaluate whether one of these defenses will protect your business.

Wilke Fleury is extremely proud to have two attorneys recognized in The Best Lawyers in America and three attorneys recognized in the Best Lawyers: Ones to Watch in America! Best Lawyers has been regarded by lawyers and the public for more than 40 years as the most credible measure of legal integrity and distinction in the United States. Congratulations to this talented group!

By Aaron Claxton and Shur Erdenekhuu

Since 2003, the Centers for Medicare & Medicaid Services (“CMS”) has conducted the Recovery Audit Contractor (“RAC”) program. As the program has expanded, provider audits have increased significantly.

What is a RAC audit and who is subject to it?

RACs are private entities that CMS contracts with to identify underpayments and overpayments to providers. RACs have a primary objective to recoup overpayments by reviewing claims submitted by providers for “which payment may be made under the State Plan or a waiver of the State Plan to identify overpayments and underpayments.”

This means, if you are a healthcare provider, you may be subject to a RAC audit when you submit a claim to Medicare or Medicaid. Physicians, DME suppliers, hospitals and other facilities are all potentially subject to RAC audits, Currently, these audits are performed by large contractors like Performant, Cotiviti, and HMS Federal Solutions, depending on which region you are located in

How is Performant compensated and how often are audits conducted?

Payment to RACs are made on a contingent basis for collecting overpayments or underpayment from the amounts recovered. Historically, the contingency fee rate for individual contractors has been anywhere from 8 to 12 percent. Performant, specifically, has been awarded a renewed 5-year contract in 2022 and has increased its audit sector.. Public data from CMS indicates an upward trend in RAC audits.

Limitations on the number of records audits can request.

Providers under RAC audits need not be passive: contractors like Performant have a limited number of records they can request in a 45-day period. A RAC may only request records on 10 percent of all paid claims within a 12-month period, every 45 days.

Defenses to RACs

Providers under audit may also challenge certain RAC findings by arguing:

If you are experiencing an RAC audit by Performant, or another audit contractor, you should take care to consult an experienced healthcare attorney to help you identify defenses and strategies.