And the winners are…

Posted on:California Optometric Association Launches Legal Resources Program July 1

Posted on:A new and exciting COA membership benefit will be available to all COA member doctors of optometry starting July 1, 2016. We are pleased to add a FREE legal resource service as an added value to the many benefits you already receive as a COA member. The benefit entitles COA member optometrists up to one-half hour (30 minutes) of telephone and research work per month with an attorney at no cost.

The COA Legal Services Resource Program will offer services that will assist members in areas of the law related the practice of optometry. Services offered are:

- Business tax issues

- Business owner succession planning

- Cal/OSHA/Prop 65 issues

- Contract issues

- Employment law

- Licensure issues

- Practice ownership and organizational structure

- Regulatory and administrative law

- California State Board of Optometry rules and enforcement issues

How will the program work?

Contact one of the designated attorneys from Wilke, Fleury, Hoffelt, Gould & Birney, LLP (see below), provide them with your COA member number, and receive a free consultation for up to one-half hour per month. This benefit will not accumulate from month-to-month.

All services are confidential. Any agreement for contracted services, beyond the COA free benefit, is between the individual optometrist and the attorney.

Meet the attorneys

- For issues pertaining to employment and practice succession, contact:

Stephen Marmaduke. Mr. Marmaduke has practiced law in California for over 35 years. One of his primary focuses is the representation of health care providers in the area of professional employment.

- For all other legal matters, contact:

William A. (Bill) Gould, Jr. Mr. Gould has been with the Wilke Fleury since 1964 and has served as COA’s general counsel for more than 50 years. His practice emphasizes health care law (including the laws affecting doctors of optometry), litigation and administrative law. During his time representing COA, he has handled all COA litigation, including the Eyeglasses I and Eyeglasses II lawsuits, and lawsuits against the Medical Board of California and others.

Daniel Baxter: A partner with Wilke Fleury since 2007, Mr. Baxter’s practice focus includes business litigation and as general counsel to clients ranging from non-profit organizations to small businesses.

Beginning July 1, access your COA legal resource services member benefit by:

- Call Wilke Fleury at 916-441-2430

- Provide your COA member number.

- Ask for the attorney who best meets your issue from the above list.

About the Law Firm of Wilke, Fleury, Hoffelt, Gould & Birney, LLP

For more than 90 years, Wilke Fleury has served businesses, governmental entities and individuals by providing comprehensive legal services with the highest standards of integrity and efficiency. The firm as gained a national reputation in the health care arena, and has served as legal counsel to COA for more than 50 years.

Wilke Fleury Seed Transactional Practice

Posted on:California Time Off to Vote: Is your election notice posted?

Posted on:California employers have to post election notices advising employees of their ability to take time off to vote when employees do not have enough time to vote outside of their working hours. Election notices need to be posted 10 days before any statewide election.

This is the week for California employers to post their election notices since the California presidential primary election is June 7. Most employers should post the election notice by Friday, May 27, 2016. For more information about the election notice, watch our Video Blog:

Check out the first in a Series of Labor and Employment Video Blogs!

Posted on:For more information, check out this month’s April Labor and Employment Newsletter, “Simply Sex? Distinguishing between sex, gender, gender identity, and gender expression,” by Samson R. Elsbernd, Esq.

*This is not legal advice. Please click here to review our Disclaimer.

Duty to Warn of Animals’ Dangerous Propensities

Posted on:In addition to all of their other responsibilities, veterinarians also have a duty to warn others of animals’ dangerous propensities. As a clinician, you owe this duty to:

- Staff members

- Animal owners

- Third parties

Warning Staff

Ensuring that your staff members understand and account for the dangers of working with animals is one of the best ways to limit the liability of your practice. To protect your staff from injuries:

- Develop clear procedures for identifying potentially-dangerous animals upon intake.

- Educate staff with regard to these procedures.

- Ensure that procedures are consistently followed.

For example, you may implement a policy that requires your staff to label the files of animals with a history of violent behavior and take extra precautions when treating these animals in the future (i.e. muzzles, physical restraints, sedation, etc).

Warning Animal Owners

When you have reason to believe that an animal poses any type of risk, notifying the owner can shield you from liability. For example, if you believe an animal to be especially violent or dangerous, you should warn the owner of this risk. Remember to be consistent when issuing these warnings. You should also document all notifications and warnings for future reference.

Warning Third Parties

In most cases, your duty to warn third parties of potential risks can be satisfied by simply warning the animal’s owner. Since the animal’s owner holds the primary responsibility for the animal’s behavior, he or she will be liable for any injuries or damage the animal causes – as long as you satisfied your obligation to warn of potential risks. However, if you do not warn the owner of a known risk, you may be held liable for these consequences.

For example, assume an animal attacks one of your technicians, but you don’t warn the animal’s owner of its propensity for violence. The animal attacks a third party the following week. In this case, you may be held legally responsible for the third party’s injuries.

ADA, FEHA and Employee Break Laws Explained for Veterinarians

Posted on:ADA and FEHA

Under the Americans with Disabilities Act and California’s Fair Employment and Housing Act, veterinarian practices are required to identify and accommodate employees with disabilities as needed. These laws also prohibit you from discriminating against an employee on the basis of a disability. Covered disabilities include any mental or physical impairment that limits one or more of the employee’s major life activities. For example, if one of your technicians suffers from Type I diabetes, these laws may require you to schedule breaks for that employee at regular intervals so that he or she can check blood sugar levels.

Meal and Rest Periods

In California, workers with shifts lasting at least five hours are entitled to one unpaid meal period of at least 30 minutes. If the employee works more than ten hours in a single shift, he or she is entitled to a second meal period of at least 30 minutes. First or second meal periods may be waived by a mutual agreement between the employer and employee, if the shifts are no longer than six hours or 12 hours respectively.

During unpaid meal periods, your employees must be relieved of all duties. They must also be permitted to leave the office. If they must remain in the office during a meal period, they must be paid for their time. Employers in California are also required to offer one 10-minute break for every four hours worked. If you fail to offer your employees a meal break or a rest break when one is mandated, you owe the employee an extra hour’s worth of pay.

Failure to Conduct an Appropriate HIPAA Risk Analysis Can Cost You!

Posted on:

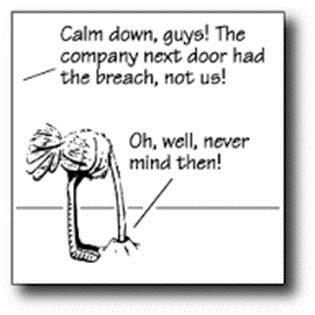

A $750,000 settlement recently paid by a large physician practice group highlights how important it is for organizations to regularly conduct proper HIPAA risk assessments.

The Cancer Care Group (based in Indiana) allegedly failed to protect electronic patient data (“ePHI”) as required by the Health Insurance Portability and Accountability Act’s (“HIPAA”) Security Rule. The Group’s compliance issues arose after an employee’s laptop bag containing unencrypted electronic patient data was reported stolen out of the employee’s car. According to the resolution agreement between the Group and the Office of Civil Rights (“OCR”), the Group failed to conduct an accurate and thorough assessment of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of its ePHI. As a result, the Group did not implement appropriate and effective policies and procedures to govern the receipt and removal of computer hardware and electronic media containing ePHI into and out of the Group’s facility. This failure lead to the improper disclosure of ePHI related to approximately 55,000 individuals and an agreement to pay $750,000 to resolve the OCR’s allegations. The Group was also required to enter a three year Corrective Action Plan to come into compliance with HIPAA.

The takeaway for all organizations covered by HIPAA is that one of the most important aspects of an effective HIPAA compliance program is the implementation of regular risk assessments. These assessments must include a thorough assessment of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of electronic protected health information held by the organization or its business associates. By conducting these assessments, organizations can uncover and prevent breaches such as those alleged against the Cancer Care Group by implementing appropriate security measures. Such measures would certainly include ensuring that any electronic health information would not leave your facility unencrypted and sitting unattended in a parked car!

The Resolution Agreement can be found at:

http://www.hhs.gov/ocr/privacy/hipaa/enforcement/examples/cancercare-racap.pdf

Dealing with Liability Threats to Your Veterinary Practice

Posted on:Veterinarians are exposed to liability threats each time they encounter a potentially dangerous animal in a clinical setting. Fortunately, you have several weapons at your disposal to minimize your risk.

Written Warnings and Notifications

The first line of defense against liability is the use of written warnings and notifications. This encompasses warnings issued to staff members and pet owners, as well as compliance with statutory notification requirements, which are requirements imposed by California law. Examples of statutory notification requirements include:

- Duty to inform law enforcement when you believe an animal has been a victim of abuse.

- Duty to inform law enforcement when you believe an animal has been injured or killed in a staged fight.

- Duty to report injuries occurring at rodeos.

- Duty to report suspicions of a rabid animal or rabid animal bite.

Referrals

In some cases, referrals of dangerous animals can help protect against liabilities.

Prescriptions

Prescription medication can sometimes help with known behavioral problems. However, it is important to provide the animal’s owner with complete, detailed instructions any time medication is prescribed.

Insurance

Since you cannot possibly neutralize every threat of liability, strive to keep appropriate insurance policies in place to protect your practice. The type and amount of coverage you need will depend on the nature of your practice, your specialty and other factors. When selecting an insurance policy, remember to consider your own personal comfort or discomfort with risk, as well as the value of your business and personal property.

Overview of Employment-Related Legal Issues Faced by Veterinarians

Posted on:As a veterinarian with a complex practice, you can be subject to a number of different employment laws. Failure to follow these laws can result in expensive, traumatic incidents that have the power to destroy the practice you have worked so hard to build. To prevent these problems, you should take the time to familiarize yourself with the various employment-related legal issues that may affect your practice. Some of these laws include:

- Discrimination – Federal and state laws prohibit you from discriminating on the basis of age, sex, disability, national origin, religion, race or other such characteristics. For example, it is illegal to exclude someone from consideration for a promotion because he or she is older than another candidate.

- Sexual Harassment – Sexual harassment laws protect workers from unwanted advances, bullying and coercion of a sexual nature. These laws encompass a wide variety of incidents, from disparaging remarks about an individual’s sex in general to requests for sexual favors.

- Whistleblower Claims – Multiple laws protect employees from retaliation when they report fraud or dangerous work conditions in good faith. For example, if an employee suspects fraud and reports his or her suspicions, you cannot take action against that employee.

- Leave Laws – When an employee is absent, several leave laws may govern the employer’s actions, including the Americans with Disabilities Act, the California Family Rights Act and/or the Family Medical Leave Act. Different laws may apply depending on the nature of the absence.

- Disability – Under the Americans with Disabilities Act, employers must identify employees with disabilities and make reasonable accommodations for these individuals.

- Meal and Rest Periods – In California, unpaid meal periods must be at least 30 minutes long, and paid rest periods must be at least ten minutes long.

- Worker’s Compensation – When employees are injured on-the-job, they can file workers compensation claims. Employers are unable to retaliate against employees who file these claims.

- Independent Contractors – Employers aren’t required to satisfy as many legal requirements when dealing with independent contractors. However, attempting to classify employees as independent contractors when they don’t meet the qualifications is never a good idea.

- Covenant Not to Compete – In general, California doesn’t allow non-compete agreements except in limited circumstances. While you can expect loyalty from employees during the term of their employment with your veterinary practice, you won’t be able to enforce any non-compete covenants after employment has been terminated.

- Electronics, Technology and Social Media – Laws pertaining to social media, technology and related issues can be complicated, and further developments are expected in this area. However, employers should have clear policies with regard to technology that detail the rights and responsibilities of employees.

Explanation of Legal Duties for California Veterinarians

Posted on:Veterinarians have a number of duties to satisfy in order to comply with the requirements of the law. Some of these duties include:

Providing Competent Care to the Patient

As a veterinarian, you have a responsibility to provide quality, competent care to every patient you encounter. This responsibility applies to every task you perform as you care for patients, including:

- Physical exam

- Diagnostic testing

- Selecting a treatment

- Performing procedures/Administering treatments

- Aftercare

- Recordkeeping

- Failing to perform a thorough exam.

- Misreading the results of diagnostic tests.

- Selecting an inappropriate treatment.

- Performing a treatment without consent.

- Recording health-related information inaccurately

- Develop procedures and protocols for keeping the premises safe.

- Teach staff members to identify and resolve threats to safety when they occur.

In order to discharge this duty, you must act competently at all times. Examples of negligence with regard to this duty include:

Supervise Staff

Veterinarians are responsible for their own actions, as well as the actions of their staff members. In fact, under a legal theory known as “respondeat superior,” you can even be held legally liable when your employees are negligent.

For example, assume an inexperienced and unsupervised employee is instructed to administer medication to a patient in Room 1 but accidentally administers the medication to a patient in Room 2. In this case, both patients may suffer side effects, and you can be held responsible for any and all of the consequences. Thus, it is essential to supervise staff members responsibly at all times.

Maintain Safe Business Operations and Facilities

As a veterinarian, you are both a clinician and a business owner. Thus, you are vulnerable to all of the same liabilities as other business owners, including on-site injuries sustained by clients, staff members and visitors. For example, if a visitor to the facility falls on a wet floor, trips over an animal’s carrier or is attacked by an improperly restrained animal, you may be held responsible for any resulting injuries.

To protect yourself and your practice, it is important to:

Veterinary Medical Board (VMB) – Protecting Your Veterinary Practice from “Cite and Fine” Issues

Posted on:The Veterinary Medical Board’s “Cite and Fine” Program was first implemented in 1990 to aid in the processing of complaints made against veterinarians. “Cite and Fine” issues can be the result of a number of problems, ranging from inadequate recordkeeping to violations in another state. These issues can not only cost your practice money, but they can also lead to more serious disciplinary actions in some cases. For these reasons, strive to protect yourself from “cite and fine” issues as much as possible. To protect your practice, follow these tips:

Keep detailed records.

Failing to keep adequate records on every patient is a common cause of “cite and fine” incidents. Not only can inadequate recordkeeping result in a citation on its own, but it can also complicate other cases that rely on complete records for evidence.

Prevent problems associated with inadequate recordkeeping by creating detailed, complete records for every patient you treat. Establish clear record keeping procedures, educate your staff with regard to these procedures, and make sure that everyone follows these systems at all times and that you and your team amend and refresh them as necessary (for instance, when your office changes locations or gets new computers).

Maintain adequate insurance coverage.

Even with preventative measures in place, you may still encounter VMB complaints. Protect your practice from financial loss by maintaining an appropriate insurance policy. The exact type and amount of insurance you will need depends on the nature of your practice, your specialty and your level of exposure, so it is wise to consult an insurance agent for guidance before you select a policy.

Consult an attorney when necessary.

When an incident occurs or a claim is filed, consult a qualified attorney early in the process. Attempting to deal with these issues on your own may lead to unnecessary financial loss, damage to your reputation and other such consequences. On the other hand, an attorney who has experience dealing with VMB cases can help you gather the evidence you need to defend yourself against the accusations and minimize the likelihood of a citation or more significant disciplinary action.

WILKE FLEURY ADDS EXPERIENCED LITIGATOR AS OF COUNSEL

Posted on:We are pleased to announce Neal C. Lutterman, former deputy city attorney for the City of Stockton, has joined our firm.

Neal’s return to private practice focuses on municipal law and defending physicians, hospitals, medical groups and allied healthcare providers in professional liability matters, both strong areas of expertise for Wilke Fleury.

Neal was the supervisor of the Litigation Division in Stockton and a member of the municipal bankruptcy project management team. He served as the primary advisory attorney to a number of key city departments, including the police, fire and administrative services, the latter of which oversaw the finance, budget, accounting, information technology and revenue divisions, as well as the police department’s code enforcement division.

Prior to his tenure in Stockton, Lutterman was a shareholder in the litigation firm of Riggio Mordaunt Kelly & Lutterman. For nearly 15 years there, Lutterman represented physicians, surgeons, hospitals and medical groups in professional negligence actions. Additionally, he successfully represented physician clients before the Medical Board of California and in proceedings before hospital credentialing committees.

EXPERIENCED HEALTHCARE LOBBYIST JOINS WILKE FLEURY

Posted on:SACRAMENTO – Lobbyist Shannon Smith-Crowley, a registered California lobbyist for more than 15 years who focuses on healthcare, women’s equity, life sciences and the biomedical industry, has joined Sacramento-based law firm Wilke Fleury in its Government Affairs group.

Smith-Crowley spent four years lobbying for the California Medical Association, where she focused on managed health care, medical staff, legal issues and reproductive health. She then founded Partners In Advocacy (PIA) in 2003 to specialize in medical and reproductive health advocacy. PIA expanded its mission over the years to address human trafficking and women’s equity legislation.

Notable legislative successes during her career include: developing California law that requires maternity coverage in all health insurance policies, well before the enactment of similar provisions in the Affordable Care Act; working on bills creating California’s public umbilical cord blood banking program, which provides unique material for lifesaving stem cell transplants and groundbreaking biomedical research; contributing to bills allowing HIV+ men to safely create families using Assisted Reproductive Technologies; and playing a pivotal role in developing the Modern Family Act, protecting the rights of intended parents, donors and surrogates.

2014 Northern California Super Lawyers and Rising Stars

Posted on:Eleven of Wilke Fleury’s attorneys have been listed as 2014 Northern California Super Lawyers and Rising Stars. The firm’s Super Lawyers are Philip Birney, Daniel Egan, George Guthrie, Ronald Lamb, Stephen Marmaduke, Thomas Redmon and Robert Tyler. The firm’s Rising Stars are Daniel Baxter, Anthony Eaton and Steven Williamson.

Super Lawyers® is a service of the Thomson Reuters, Legal Division. Each year, the research team at Super Lawyers® undertakes a rigorous multi-phase selection process that includes a statewide survey of lawyers, independent evaluation of candidates by the attorney-led research staff, a peer review of candidates by practice area and a good-standing and disciplinary check.

Super Lawyers® can be found online at www.superlawyers.com.

by

by  by

by  By

By  by

by  By

By